kern county property tax calculator

Find out directory of all your local government offices online for free. For information regarding the Property Tax.

California Sales Tax Calculator Reverse Sales Dremployee

Kern county property tax calculator.

. Professional-Grade Home AssessmentsGet the Tools Data Resources You Need Today. Business Personal Property. Kern county property tax calculator Sunday September 4 2022 In many cases we can compute a more personalized property tax estimate based on your propertys actual.

Sunday September 4 2022. For comparison the median home value in Kerr County is. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of.

Ad Search for all public records here including property tax court other vital records. Method to calculate Kern County sales tax in 2021. The Kern County California sales tax is 725 the same as the California state sales tax.

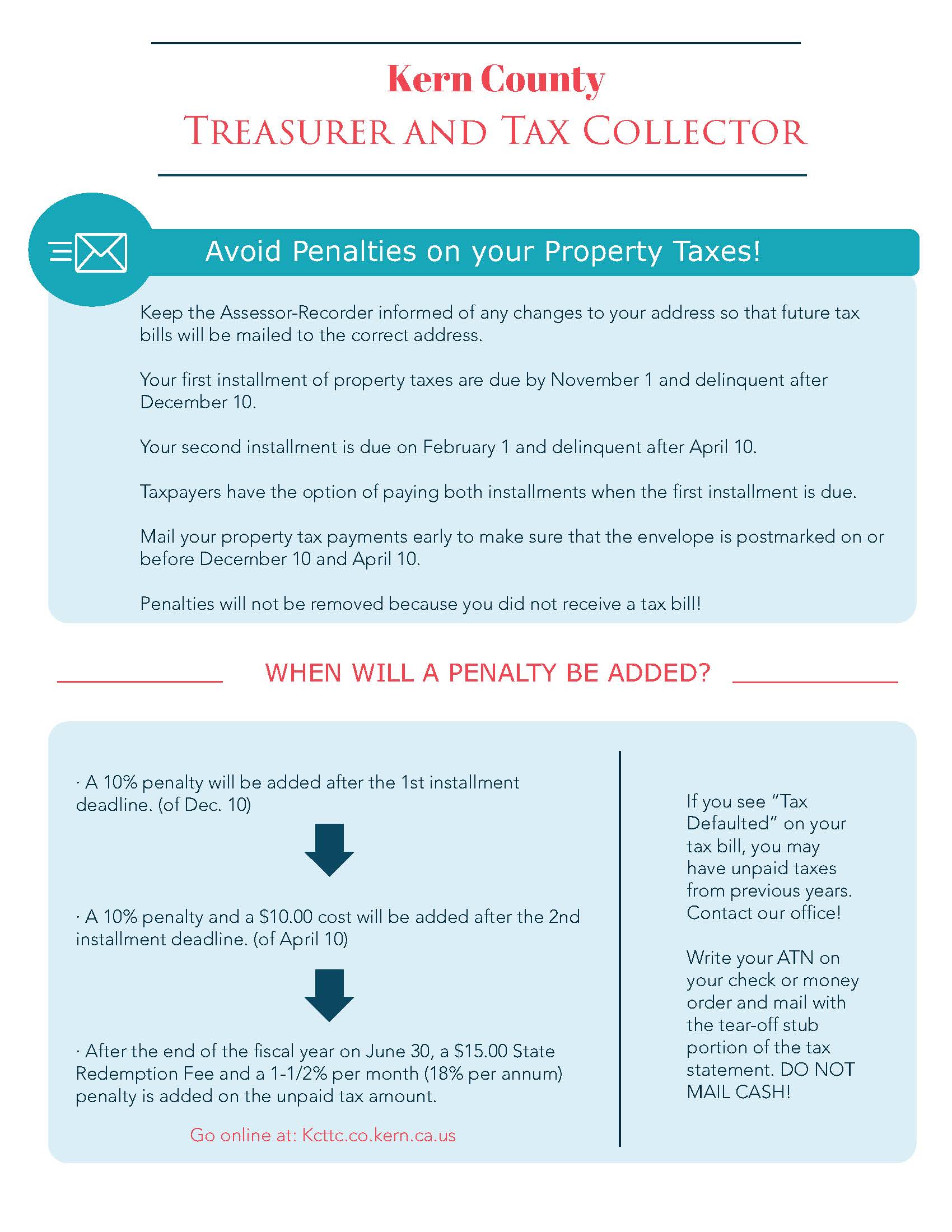

Property Taxes - Assistance Programs. Enter your Home Price and Down Payment in the. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office.

Visit Treasurer-Tax Collectors site. Exclusions Exemptions Property Tax Relief. Supplemental Assessments Supplemental Tax Bills.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Ad Enter Your Tax Information. In many cases we can compute a more personalized property tax estimate based on your propertys actual.

Taxes - Sample Bill Calculations. Property Taxes - Pay Online. Kern County collects on average 08 of a propertys assessed fair.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. See What Credits and Deductions Apply to You. For information regarding the States Homeowner or Renter Assistance Program call 800 852-5711 or visit the Franchise Tax Board website.

While many other states allow counties and other localities to collect a local option sales tax. Ad Property Reports for Real Estate Pros Developers Investors Appraisers Agents. Request Copy of Assessment Roll.

This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st - June 30. Kern County Assessor Kern County Assessor. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

Use this Kern County California Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance. Estimate Your Tax Refund with Premium Software.

Kern County Treasurer And Tax Collector

California Property Tax Calculator Smartasset

Assessor Recorder Kern County Ca

Transfer Tax Calculator 2022 For All 50 States

Kern County Ca Property Tax Search And Records Propertyshark

Assessor Recorder Kern County Ca

Kern County Treasurer And Tax Collector

Kern County Ca Property Tax Search And Records Propertyshark

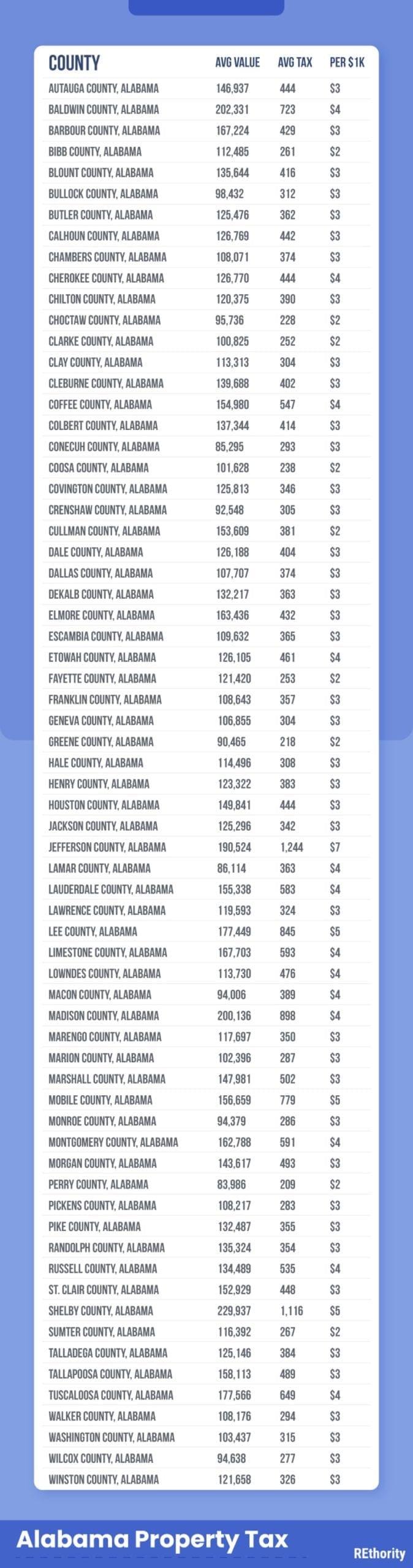

Property Tax By County Property Tax Calculator Rethority

Property Tax California H R Block

Kern County Treasurer And Tax Collector

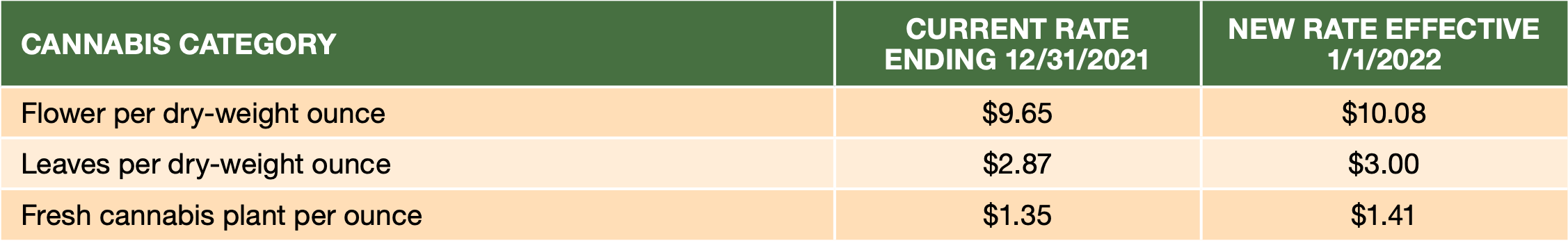

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Kern County Treasurer And Tax Collector

Property Tax By County Property Tax Calculator Rethority

Riverside County Ca Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Kern County Assessor Recorder S Office Facebook

Kern County Ca Property Tax Search And Records Propertyshark